EDUCATIONAL OFFER

LMU plans to offer the following courses:

- Stochastic calculus and Arbitrage Theory in Continuous Time - 9 ECTS

- Computational Finance and its Object-Oriented implementation (with Application to Interest-Rates and Hybris Models) - 9 ECTS

- GrEnFIn Seminar - 3 ECTS

Electives (9 ECTS in Total):

- Topics from Statistics (9 ECTS)

- Microeconomics (6 ECTS)

- Macroeconomics (6 ECTS)

- Econometrics (6 ECTS)

- Mathematical Seminar (3 ECTS)

UNIBO plans to offer 4 courses (24 CFU) in the second semester of a.y. 2021/2022 and the thesis supervision in the GrEnFIn field (18 CFU). The offered courses are:

(Risk and Finance Track):

- GrEnFIn-Credit Risk and Climate Change

- GrEnFIn-Asset Management and Transition Risk

(Scientific/Technological Track):

- GrEnFIn-Smart Grids for Smart Cities

(Social Welfare-Policy and Economics Track):

- Intensive Program in Energy Market

UEK plans to offer courses and the thesis supervision in the GrEnFIn field (18 CFU). The offered courses are:

- Advanced Topics (Credit Risk) - 6 ECTS

- Advanced Issues in Corporate Financial Management - 6 ECTS

- Measurement of Credit Risk - 4 ECTS

- Measurement of Market Risk - 4 ECTS

- Alternative Investments - 2 ECTS

- Structured Products - 2 ECTS

- Master Thesis Seminar - 18 ECTS

- GrEnFIn - with Associate Partner / Green Energy Problems (6 ECTS)

- GrEnFIn - at Partner "green" institution (6 ECTS)

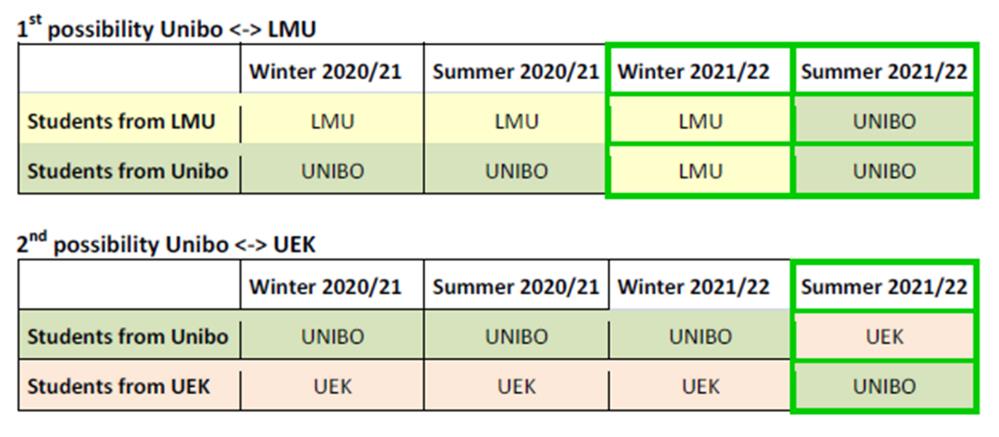

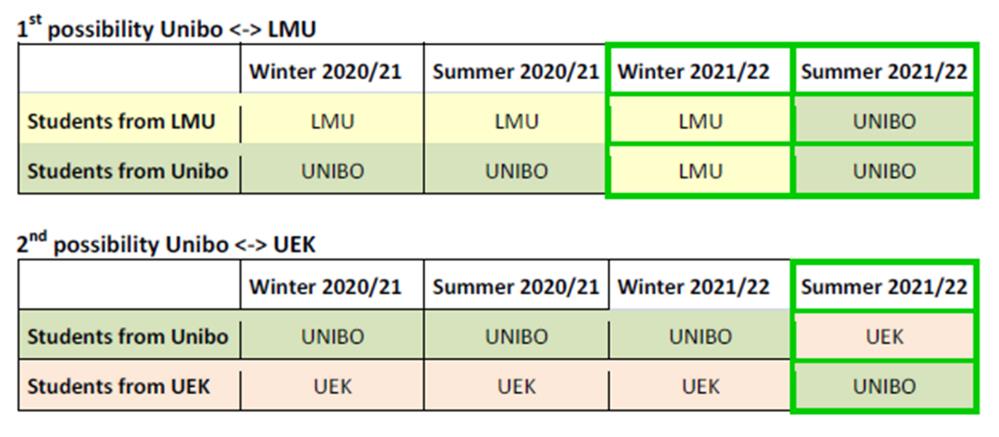

The exchange periods are detailed in the following table:

GrEnFIn-EACEA will award the certificate of Sustainable Energy Expert-cohort zero to the pilote class members.

Students must apply to Erasmus grants. Selection criteria by Erasmus application (Erasmus Call, 12 January 2021) are the following:

- GPA 50% - good academic achievements, sufficient knowledge of quantitative finance

- Motivation letter 25% - Interest for ``Green Energy and Finance``, i.e., environmental topics, economic topics, etc

- ELP 25% - Sufficient knowledge of the English language