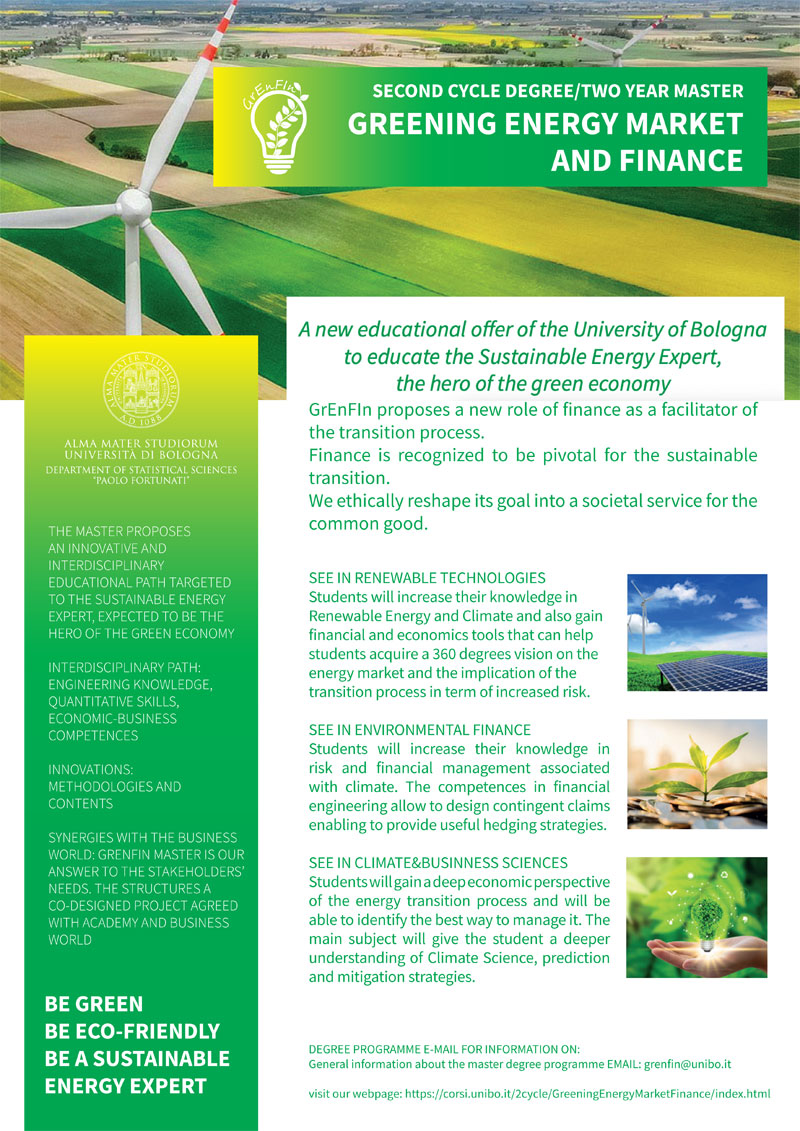

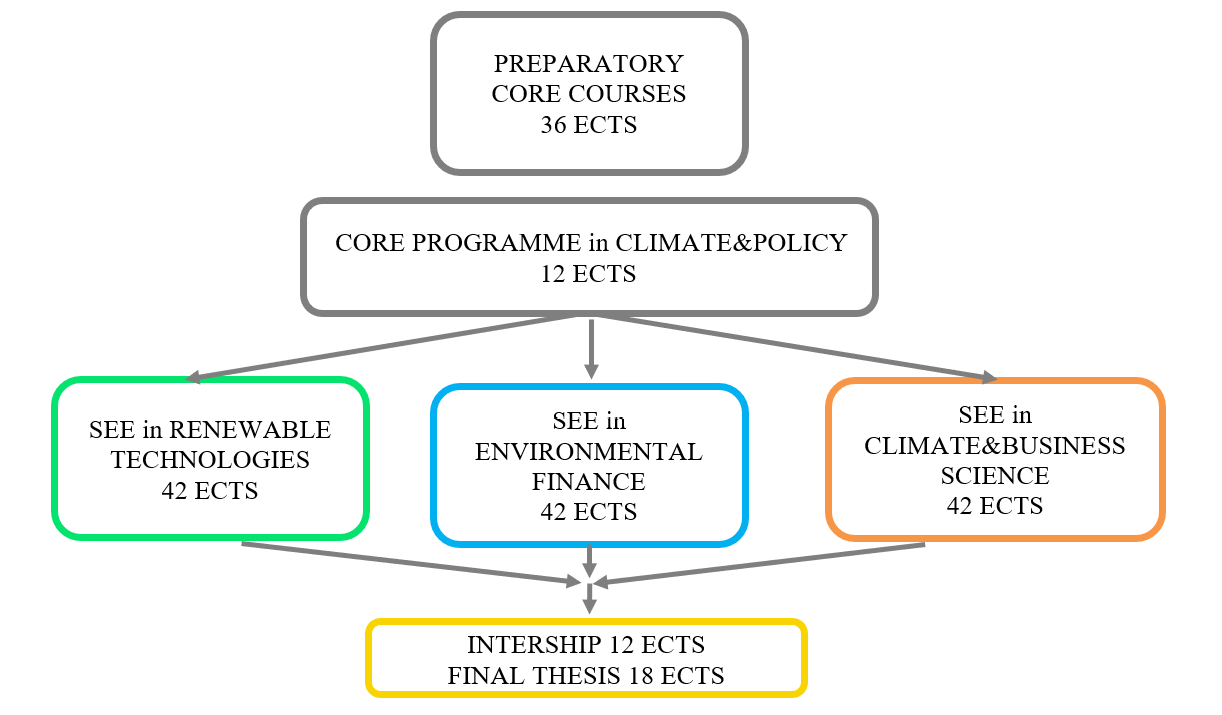

The Preparatory courses are intended to provide a fundamental background common to all students and undeniable to have a good knowledge of the fields required in the next specialized modules.

The preparatory courses will provide a good knowledge of probability theory and stochastic processes, either diffusive and with jumps. The students will master the main principles and tools of financial mathematics, pricing and the hedging techniques; in particular they will be able to design a process of market risk measurement and reporting, and to make market risk management decisions.

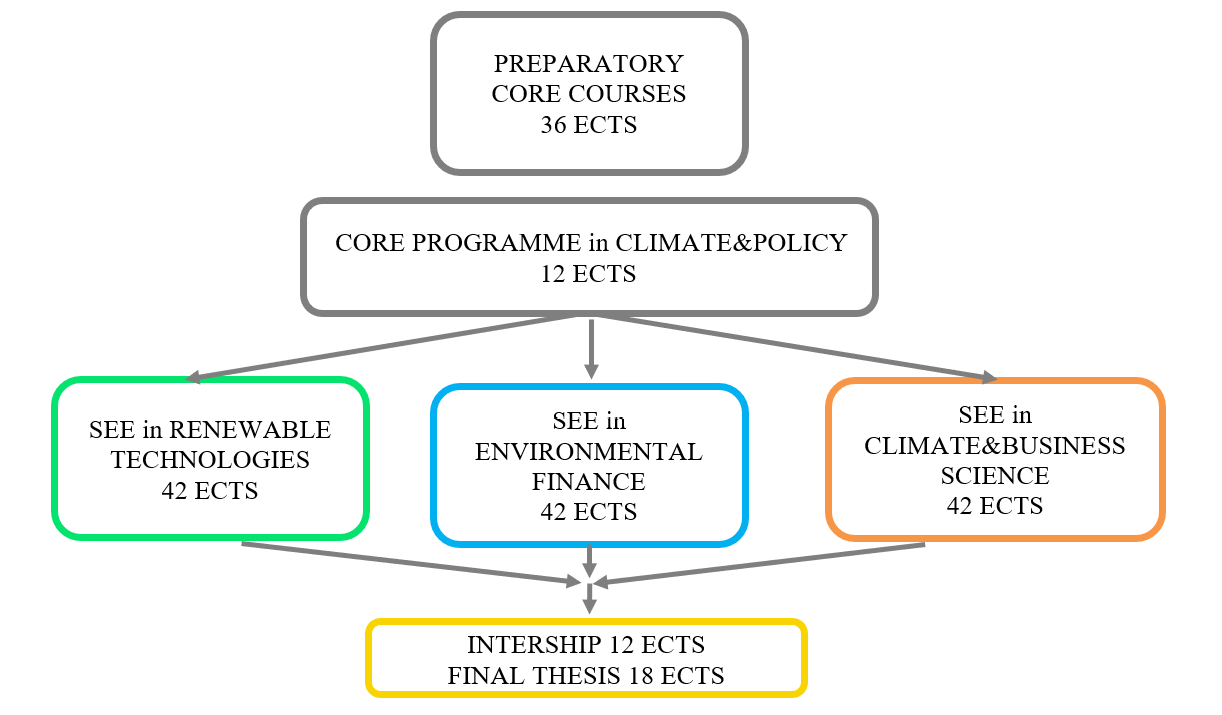

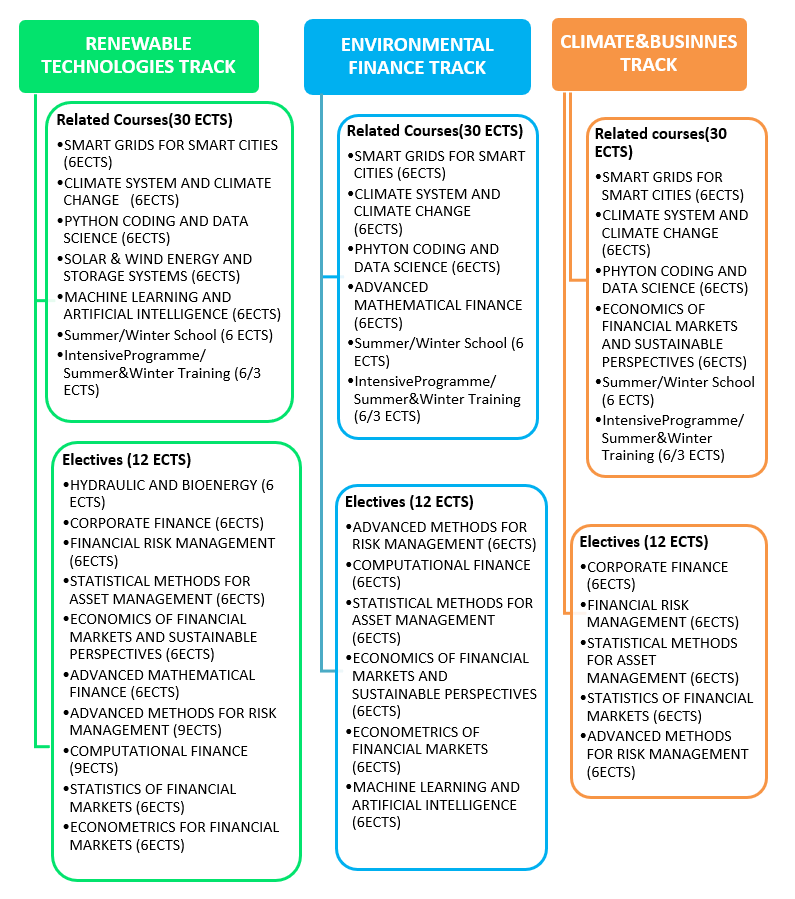

The specialization phase aims to provide a deep knowledge on the chosen track. The main understanding of the specialized field is given through the Related courses, which are compulsory and could be seen as core courses for the specialization at hand. Nevertheless, students have the chance to tailor the educational path choosing their favorite courses among the class of the elective ones.

In the Core courses students are expected to have a complete knowledge of the principles, bodies and the main regulatory provisions. Particular focus will be devoted to the international aspect of financial regulation, both about the issue of stability (Basel regulations and Financial Stability Board) and transparency (market abuse and MIFID regulations) with particular attention to the climate policies.

The Internship is always compulsory in order to stress the important role of industries in the project. The student will develop a deep knowledge of green energy solutions but keeping in mind a holistic and interdisciplinary view which is expected to be strong firm’s oriented.

The main fields of education are:

- Maths and Probability,

- Engineering competences of the energy sources,

- Sustainable economics,

- Risk management and Financial engineering.

Potential Professional Profiles:

| Professional Profile |

Sustainable Energy Expert specialized in Renewable Technologies |

| Functions & Competences |

- Cost effective and climate efficient supply decisions

- Regulatory framework for the private sector

- Regulator decision making support for the Sustainable Development Goals

- Climate Risk evaluation for Renewable Energies

- Climate impact analysis of the strategic choices

- Ideation, elaboration, redaction, creation, financing, promotion, monitoring and evaluation of programs on Climate Sustainability

- Technical support for international agreements in the field of Energy Transition and Climate Change

- Energy Resources management (production and storage)

|

| Occupational Positions |

- Sustainable energy consultant for the private sector

- Economical – Financial Institutions for the monitoring of the environmental impact

- National and European regulating authorities

- International Organizations like EU, World Bank, IMF, OECD

- Private firms and corporations for energy supply

- Private and public administrations, regional and local, for environment protection

|

| Professional Profile |

Sustainable Energy Expert specialized in Environmental Finance |

| Functions & Competences |

- Evaluation of the natural variables involved in the overall Corporate Risk assessment

- Impact of climate change in corporate decision making

- Skills required to design new financial instruments to cover, at least partially, the risk from the exposition of natural variables and catastrophic macro events

- Coordination, elaboration, redaction, creation, financing, promotion, monitoring and evaluation of national and international programs on sustainability and risk control

- Research in the economic and financial field, creation of innovative hedging products

|

| Occupational Positions |

- Financial and risk manager

- Financial engineer for banks and institutions

- Sustainable Energy Consultant for the private sector

- National, regional and local Administrations for the management of climate risk and the energy transition

- National and European regulating authorities

- Non – profit organization and public institutions for the environmental and transition risk

- International Institutions (ECB, IMF, OCSE, European Commission, World Bank)

- Consulting Firms

|

| Professional Profile |

Sustainable Energy Expert specialized in Climate&Business |

| Functions & Competences |

- Empirical and simulated analysis of climate scenarios, including drastic events.

- Statistical analysis of financial events in a climate impact hedging.

- Statistical software knowledge

- Portfolio management in the framework of climate impact and transition risk

- Corporate risk management

- Regulator support in decision making process over climate change and policy impact on the productive system.

- Asset management, including green financial product management

- Investments and corporate governance evaluation.

|

| Occupational Positions |

- Sustainable Energy Consultant for the private sector

- Local, National, International Public Administration for the management of climate risk and drastic events.

- National and European Regulating Authorities

- International Institutions (ECB, IMF, OCSE, European Commission, World Bank)

- Research Institutes (private and public)

- Consulting firms

|