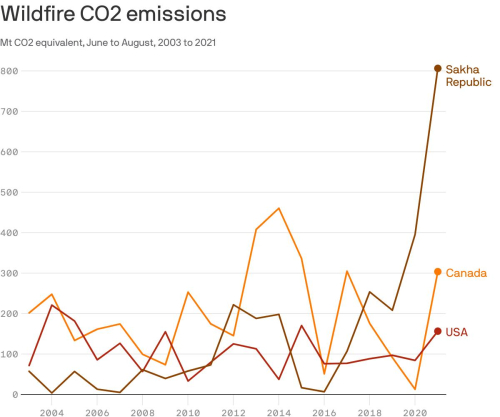

The widespread wildfires that stretched across the Northern Hemisphere during the last two Summers set records for their carbon dioxide emissions, particularly in Siberia (see below the graph of CO2 emissions in the Sakha Republic)

Why it matters: The severe fire season in Siberia is tied in part to unusually warm conditions with low soil moisture, which studies have linked to human-caused climate change.

The wildfire season across the boreal forests of the Far North typically stretches from May to October.

During the June through August period 2021, wildfires in the Sakha region of northeastern Siberia emitted enough carbon dioxide to rival the annual emissions from Germany in 2019, according to the Copernicus Atmosphere Monitoring Service (CAMS)

August 2021 set a monthly record for wildfire emissions coming from the Northern Hemisphere, and Siberian emissions were more than twice the total from the June through August timeframe last year, CAMS' satellite data shows.

As the climate warms due to human emissions of greenhouse gases from fossil fuel burning, extreme wildfire years are expected to become more common and burn in ecosystems where they were previously uncommon.

If fires burn intensely in regions with permanently frozen soil known as permafrost, it could free up currently frozen organic matter locked away for centuries, emitting CO2 and CH4. It is worth noting that the latter, methane , constitutes the bigger part of what is called ‘Natural Gas’ and is dangerous for humans because of the rapid breathing and heart rate it creates. Methane was an important subject at the Climate Glasgow meeting.

In summer 2021 California wildfires, dominated by the nearly one million-acre covered by ‘Dixie Fire’ –wildfires now get names, like hurricanes - sent twice the amount of CO2 into the air compared to 2020, also a severe wildfire season.

The General Sherman Tree — a giant sequoia that is the world's largest tree by volume — has its base wrapped in a fire resistant aluminum blanket to protect it from the heat of California's wildfires.

During the last two summers, firefighters were racing to save the famous grove of gigantic old-growth sequoias from fires in the Sierra Nevada.

The Colony Fire in Sequoia National Park was so large that it deserved a name, like the Dixie Fire

California wildfires have burned into at least four groves of gigantic ancient sequoias in national parks and forests.

The fires lapped into the groves with trees that can be up to 200 feet (61 meters) tall and 2,000 years old, including Oriole Lake Grove in Sequoia National Park and Peyrone North and South groves in the neighboring Sequoia National Forest.

A fire also had reached the forest’s Long Meadow Grove, where then-President Bill Clinton signed a proclamation two decades ago establishing it as a national monument.

“These groves are just as impressive and ecologically important as the forest. They just are not as well-known,” the sequoia restoration and stewardship manager for the ‘Save the Redwoods League’ stated.

During Summer 2022, the warmest summer ever recorded in Europe in the French Department of Gironde which is home to many pine trees and forests, wildfires devastated 19 300 hectares of land and displaced 34 000 persons within one week in July. As of September, some wildfires were still continuing. Algeria, Portugal and Spain were not spared from the second –largest wildfires on record in these countries.

U.S. House Speaker Nancy Pelosi said a few days ago that the federal government has to do more to help with recovery in the wake of a devastating wildfire that charred several hundred homes and destroyed the livelihoods of many rural residents of the US New Mexico state.

The wildfire forced the evacuation of thousands of residents from villages throughout the Sangre de Cristo mountain range as it burned through more than 1,373 square kilometers of the Rocky Mountain foothills. Experts say the environmental consequences will likely span generations while immediate consequences for agriculture and water quality were taking place in the rural state of New Mexico.